Total Term (Tt)

6min read.

🏠 What is Total Term and Why Is It a Game Changer?

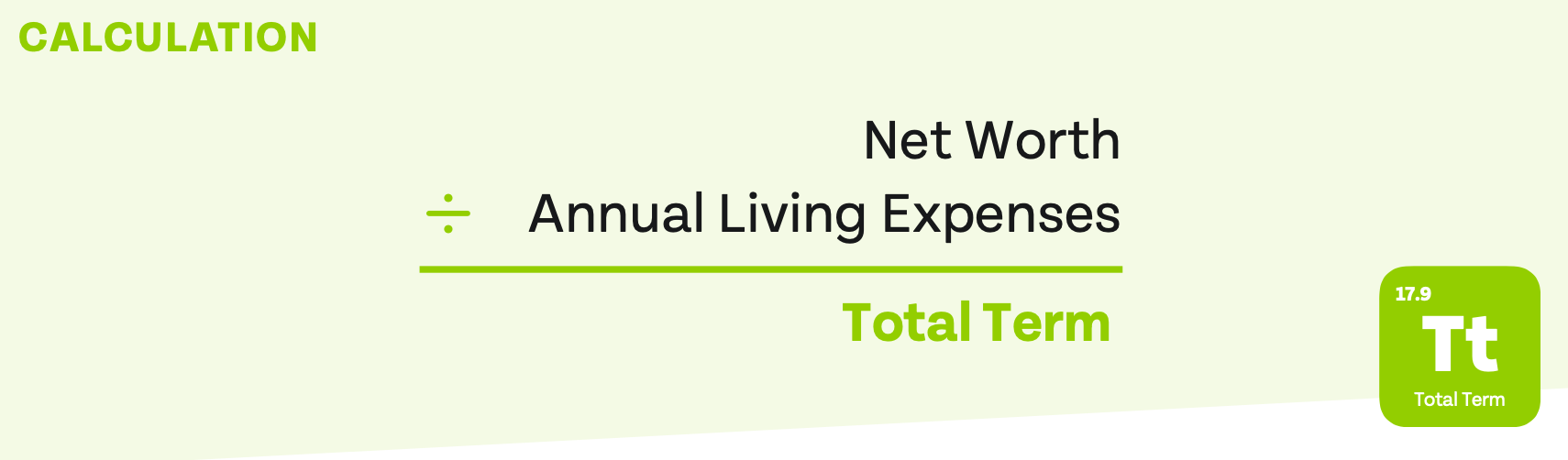

Total Term (Tt) is a powerful yet easy-to-understand metric that estimates the number of years you can maintain your current lifestyle based on your existing assets, assuming no changes in spending or asset growth. For instance, if your net worth stands at $1,000,000 and you spend $100,000 annually, your Total Term (Tt) equals 10, meaning you can live for about ten years with your current assets.

Grasping the concept of Total Term is the key to evaluating your financial freedom and security. It addresses burning questions like "How am I doing?" or "Do I have enough money?" by delivering a clear-cut answer in years, not dollars. Tracking Total Term changes over time sheds light on your journey towards financial independence, offering invaluable insights.

📚 Demystifying Total Term Components

Total Term comprises four essential elements: Liquid Term, Qualified Term, Real Estate Term, and Business Term. Delving into each component will help you gain a thorough understanding of your financial health and determine if you're adequately prepared for a comfortable retirement.

Step 1: Guarantee Score Accuracy

Accurate Total Term calculation hinges on up-to-date net worth and spending data. Make it a habit to update asset and liability values regularly, following these guidelines:

Remember to account for student loans and consumer debts that impact your net worth but aren't necessarily linked to specific assets.

Step 2: Expertly Assess Your Total Term Score

When dissecting your Total Term score, consider the following crucial factors:

Score ranges based on age: Your Total Term will generally evolve non-linearly as you age, experiencing smaller growth rates in earlier years and more significant growth rates later in life. Here's a breakdown of average Total Term scores and their associated growth rates based on age ranges:

Correlating factors: Examine how lower or higher Total Term scores may be influenced by future income, retirement date, and age factors.

Asset mix: Investigate the balance of Liquid Term, Qualified Term, Real Estate Term, and Business Term assets to determine if your mix is suitable for your retirement strategy.

Step 3: Identify and Implement Areas of Improvement

To elevate your Total Term and overall financial health, contemplate these pivotal questions:

What is the underlying asset mix?

Is your Total Term overly reliant on certain asset types?

In which term elements can you feasibly make improvements?

Focus on the following aspects to enhance your Total Term score:

Savings: Pinpoint areas where you can save more or where additional savings should be directed.

Spending: Reassess your spending habits to identify if reductions or increases are necessary.

Debt reduction: Explore opportunities to accelerate debt payoff or refinance to improve cash flow.

Asset/income growth: Reallocate investments for different growth rates, seek ways to increase your income or invest more in your business or private ventures.

🔑 Case Study: Applying the Total Term Assessment Principles

Let's dive into a case study to demonstrate how you can apply the Total Term principles.

Example: Imagine you have a Total Term of 12.9, with the following details:

Liquid Term (Lt) = 1.7

Qualified Term (Qt) = 4.1

Real Estate Term (Rt) = 1.1

Business Term (Bt) = 6.0

Additionally, your lifetime income is $2.7 million, you're 52 years old, your future retirement income provides a 40% income replacement, and your target retirement is about 10 years away.

Step 1 - Determine Score Appropriateness: Considering your age, a Total Term of 12.9 falls short of the average. Factoring in your shorter time until retirement and significant income replacement, it becomes evident that your Total Term is too low for your needs.

Step 2 - Identify Improvements: Through data analysis, you discover the potential to save extra money each month. You aim for a healthy Total Term growth year over year, using that as your benchmark.

🧭 Harnessing the Power of Total Term

And there you have it! Total Term isn't just a fancy metric; it's your financial compass, guiding you towards a future where money woes are a thing of the past. Like a trusty GPS, it helps you navigate through the complex world of assets and spending, showing you exactly how many years you can sustain your current lifestyle. Remember our case study? It's like being the captain of your own ship, steering towards the shores of financial freedom. You're not just crunching numbers; you're crafting a life rich in security and prosperity.

But hey, don't just take my word for it. Dive into your own Total Term assessment. It's like doing a jigsaw puzzle – fitting all the pieces of Liquid Term, Qualified Term, Real Estate Term, and Business Term together. You might be surprised at what you find. Maybe you're closer to your dream retirement than you think, or perhaps there's some tweaking to do. Either way, knowledge is power, and in this case, it's the power to live your golden years on your terms.

As always - stay on point!